Next Portal

We are pleased to announce the introduction of the Next Portal 1.1.0, a significant addition to our suite of digital platforms designed to elevate banking services for our customers, starting from Nov 20, 2023.The primary objective behind the launch of the Next Portal is to offer enhanced convenience to our clients, complementing the existing Next Mobile App. We strive to provide quick access to superior financial services, ensuring a seamless and efficient banking experience for our valued customers.

Initially tested by our internal employees as a market-viable product, the Next Portal has undergone rigorous evaluation to ensure its reliability and effectiveness. Building on the success of this internal testing phase, we are now excited to extend the availability of the Next Portal to our existing customers. Our focus is particularly directed towards individuals who may face challenges in downloading and utilizing the Next Mobile App. The Next Portal serves as an accessible alternative, catering to the diverse needs of our customers. To access the Next Portal, users may conveniently navigate to the following link: https://nextportal.yomabank.com/.

The detailed features of Next Portal Version 1.1.0 are as follows

- Activation

- Login

- Acc Transfer (Own Acc, Other Acc, Other Bank, WavePay)

- Bill Payment & Mobile Topup

- Deposit & Fixed Deposit Acc Overview

- Account Overview & Detail

- Download Account Statement

- Add Receivers

- Transaction History

- Forget Password

- Open FD and Super FD

- Open Flexi Everyday

Business Banking Portal

The primary objective of the YOMA Bank Business Banking Portal is to provide improved financial services with expeditious and straightforward accessibility for our esteemed SME and Corporate customers. The existing portal, currently catering to SME and Enterprise customers, is scheduled to cease its services shortly. In replace of this, YOMA Bank has introduced the YOMA Bank Business Banking Portal (BBP) Version 1.1, effective from November 2, 2023. To use the business banking portal(BBP) provided by YOMA bank, SME & Enterprise customers can kindly access the portal via the following link: https://businessbanking.yomabank.com.

| Feautes | Currently Utilized in DC Enterprise Portal | New Business Banking Portal |

|---|---|---|

| Self-Reset Password | Allow customers to initiate password reset with the minimum requirement. | |

| Transaction History Download | Allow customers to download a file containing transaction details. | |

| Notification Services | Real-time notifications for transaction requests, status updates, and as requested by the customer. | |

| Loan Enquiry and Details | Allows customers to access comprehensive information, including repayment schedules and payment details. | |

| Interbank Transfer | Up to other 10 banks | More than other 50 banks |

| Mobile Top-Up | No Discounts | Offers a 1.5% discount for Smart and Flexi Everyday Account holders upon topping up. |

| Localization | Myanmar, English (2 languages) | Myanmar, English & Chinese, offering a trilingual interface. |

| Account Statement | Only available until previous month | Allows customers to retrieve account statements on-demand for specific days, months, or periods. |

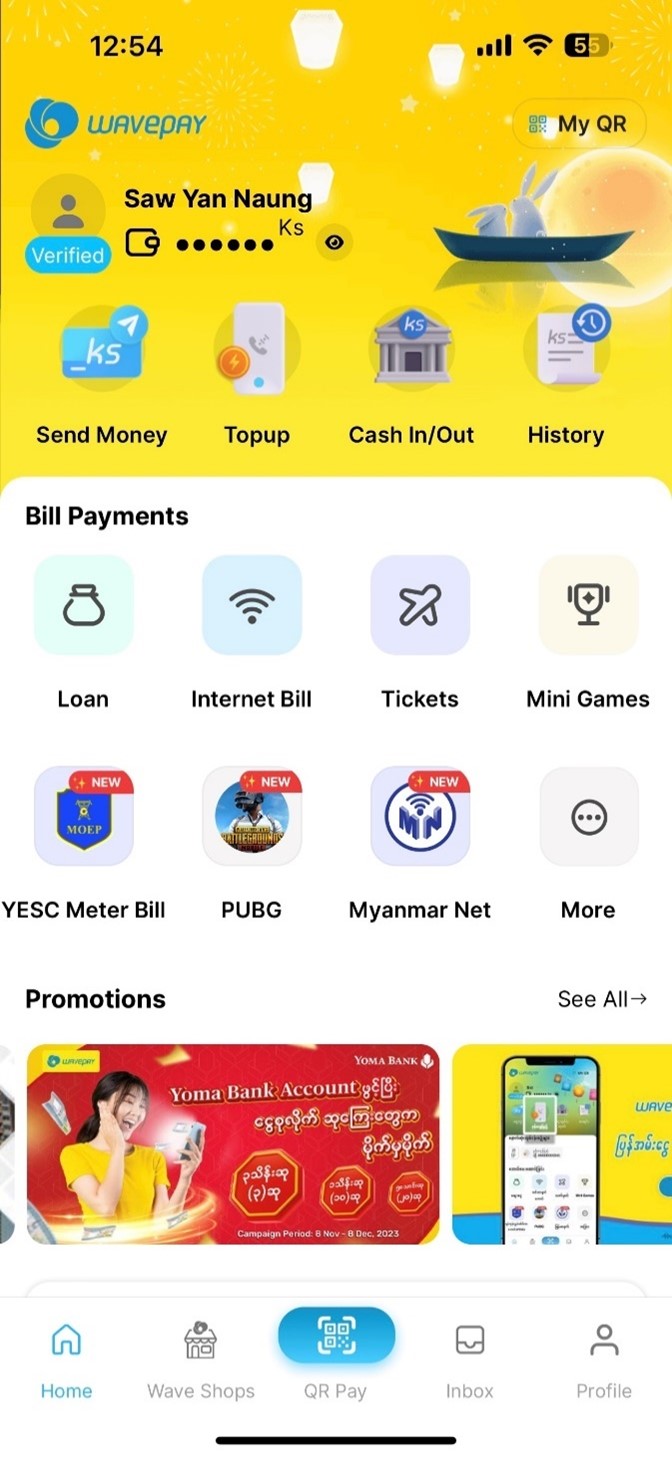

YoWave: Enhanced YB Onboarding Approach & Campaign

WavePay Customers can now easily open Yoma Bank Flexi Everyday account on their WavePay App by clicking on the Yoma Bank banner in “Promotions” session. With the recent integration with Wave’s KYC data sharing API, customers will have their personal information pre-populated in the Yoma Bank application portal for their convenience. It is a step towards convenient and intuitive simplified customer onboarding experience with minimal input. Apply Flexi (yomabank.com)

Along with the enhancement in the application form, Yoma Bank has launched a campaign between Nov 8th and Dec 8th 2023 for customers who used the banner in WavePay App to open Yoma Bank accounts. For every 30,000 MMK customers deposit into their newly opened accounts, they will be eligible for a lucky draw ticket which can win cash prizes such as 300,000 MMK, 100,000 MMK and 50,000 MMK. The criteria is that customers must have downloaded and activated Yoma Bank’s Next Application.